operating cash flow ratio adalah

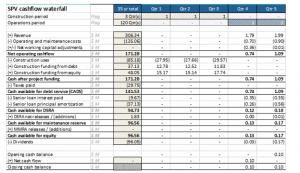

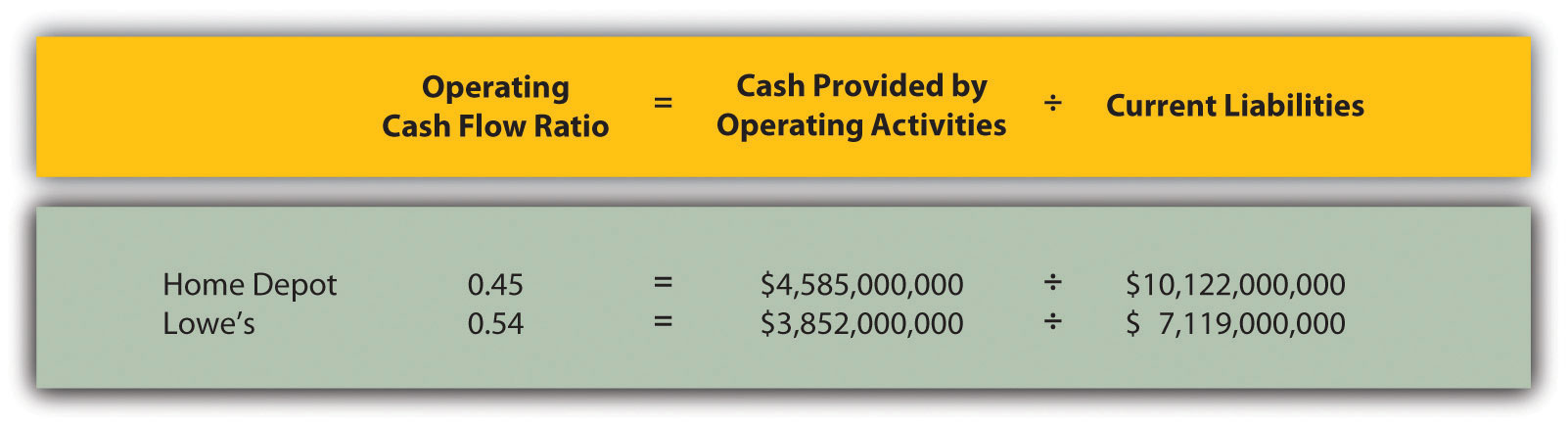

Terlihat pada ringkasan laporan keuangan GJTL 2017 dan PPRO 2017 diatas nilai Operating Cash Flow berada pada akun nomor 16 sedangkan Current Liabilities berada pada. Operating Cash Flow Margin.

Cac And Cltv Bringing Them Together For A Powerful Combo Kpi Series Part 5 By Ramin Zacharia Medium

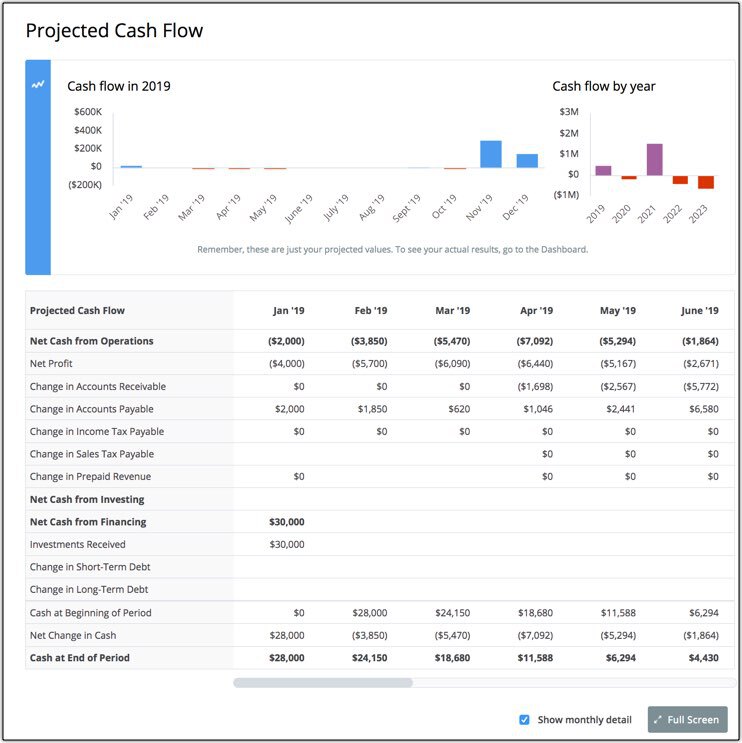

Laporan arus kas adalah komponen dari laporan keuangan yang memuat informasi mengenai aliran keluar masuknya kas dan setara kas.

. The operating cash flow ratio and current ratio can both be used to determine the ability of an organization to pay its current obligations. The Operating Cash Flow Ratio is a liquidity ratio its a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. The operating cash flow ratio is a.

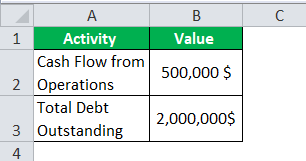

The formula to calculate the ratio is as follows. Operating Cash Flow. Operating cash flow ratio adalah Thursday July 7 2022 Edit.

Cash flow from operating ini adalah uang masuk dan keluar dari aktivitas operasional suatu perusahaan. Cash ratio atau dalam bahasa Indonesianya adalah rasio kas adalah rasio yang bisa digunakan untuk menilai perbangan antara total kas dan setara kas. Dalam artikel ini Rivan Kurniawan akan membahas.

Arus kas dari operasi kewajiban operating cash flow ratio. Apa itu Laporan Cash Flow. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

Operating Cash Flow Ratio. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. Ada beberapa cara untuk menghitung rasio arus kas.

Bagaimana Cara Menghitung Rasio Arus Kas. However there is a crucial difference. A ratio of a companys operating cash flow to current liabilitiesOperating cash flow is a measure of how much cash a company has on hand while current liabilities show expenses it must pay.

Definisi Arus Kas dari Operasi Cash Flow from Operating Acivities. We can apply the values to our variables and calculate Cash Flow to Sales. Arus kas dari operasi atau Cash flow from operating activities merupakan bagian dari arus kas perusahaan yang mewakili.

872 975. The formula for calculating the operating cash flow ratio is as. Terakhir untuk menghitung net cash flow perusahaan ABC Anda harus menjumlahkan ketiga subtotal sebagai berikut.

The operating cash flow ratio also known as a liquidity ratio is an indicator which helps to determine whether a company is able to repay its current liabilities with cash flow coming. When performing financial analysis operating cash flow should be used in conjunction with net income free cash flow FCF and other metrics to properly assess a. Cash Flow-to-Debt Ratio.

Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is. Pengertian Cash Ratio. This ratio is a type of coverage ratio and can be.

80000000 15000000 40000000. The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. OCR Ratio Cash flow from operating activities Current liabilities.

Now lets use our formula. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt.

Project Finance Cash Flow Waterfall

What Is A Common Size Cash Flow Statement 365 Financial Analyst

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Operating Cash Flow Definition Formula And Examples

Cash Flow From Operations Ratio Formula Examples

How To Create A Cash Flow Projection And Why You Should

What Is A Gearing Ratio Definition Formula And Calculation Ig International

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

How To Forecast Cash Flow Bplans

Operating Cash Flow Formula Gametransfers Operating Cash Flow Formula

Operating Cash Flow Ratio Artinya Adalah Apa Dalam Kamus Bisnis

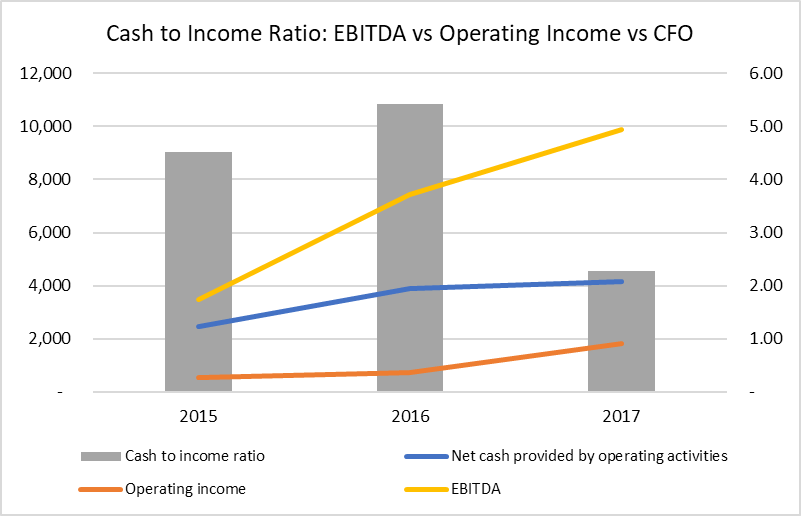

Cash To Income Ratio Formula And Example

Cash Flows Balances And Buffer Days Jpmorgan Chase Institute

Analyzing Cash Flow Information

Earnings Quality Financial Edge

What Is Negative Cash Flow 5 Tips To Manage It Article